GenuTax Standard - Program Help - Using the Interview

The simple, easy-to-understand interview in GenuTax Standard takes you step-by-step through your tax situation for the year, assisting you in claiming every tax deduction and credit that you are entitled to.

Read each screen in the interview carefully. After you have entered the required information on a screen, click the "Next" button, or press the F8 function key at the top of your keyboard, to move to the next screen.

To move back to the previous screen, click the "Previous" button, or press the F7 function key at the top of your keyboard.

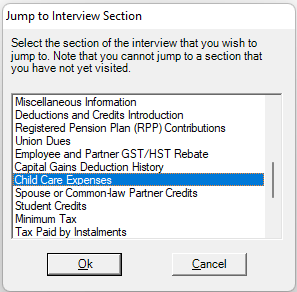

To go back to a section of the interview that you have already completed, click the "Jump to Section" button, or press the F9 function key at the top of your keyboard. The following dialog, having a list of the sections in the interview, appears:

The section of the interview that you are currently completing is highlighted in the list. You may have to scroll up or down in the list to find the section that you would like to jump to. Click the section you would like to jump to, and then click the "Ok" button to proceed.

However, please note that you can only jump to a section of the interview that you have already completed. You cannot jump past questions that you have not yet answered.

While using the interview, if you would like more information on the tax topic related to the current screen, click the "Tax Help" button, or press the F1 function key at the top of your keyboard.

As you proceed through the interview, if there is a problem with one of your entries, a red dot will appear beside the entry field. Move your mouse pointer over the dot to see the error message.

When answering Yes or No questions on an interview screen, you can press the Y key to answer "Yes", and the N key to answer "No".

At certain points in the interview, you are given the opportunity to enter the numbers from your information slips. Click here for more information on the Information Slips dialog box.

Streamlined Interview

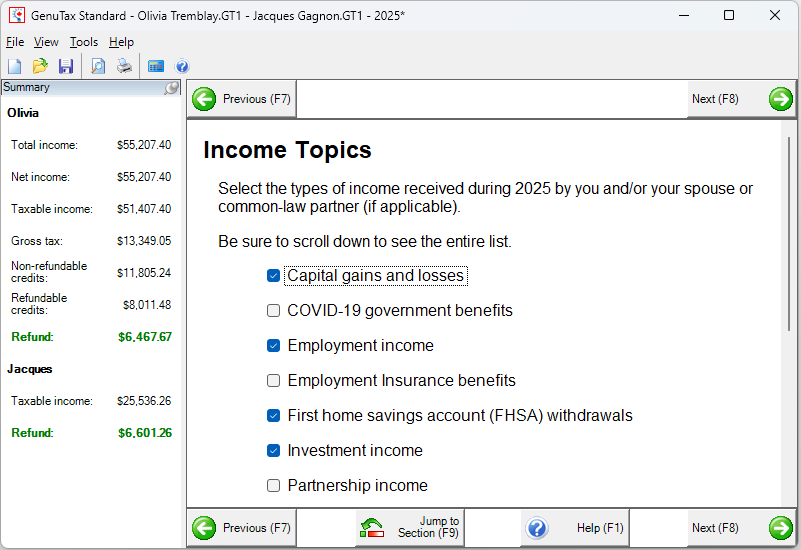

GenuTax Standard offers the choice of using either the comprehensive interview or the streamlined interview. Most individuals should use the comprehensive interview. The comprehensive interview will assist in getting every tax deduction and credit that you are eligible for.

However, if you are very familiar with tax concepts, you could use the streamlined interview. When using the streamlined interview, you select only the tax subjects that apply specifically to your situation. This allows you to very quickly complete your tax return.

Spouses or Common-law Partners

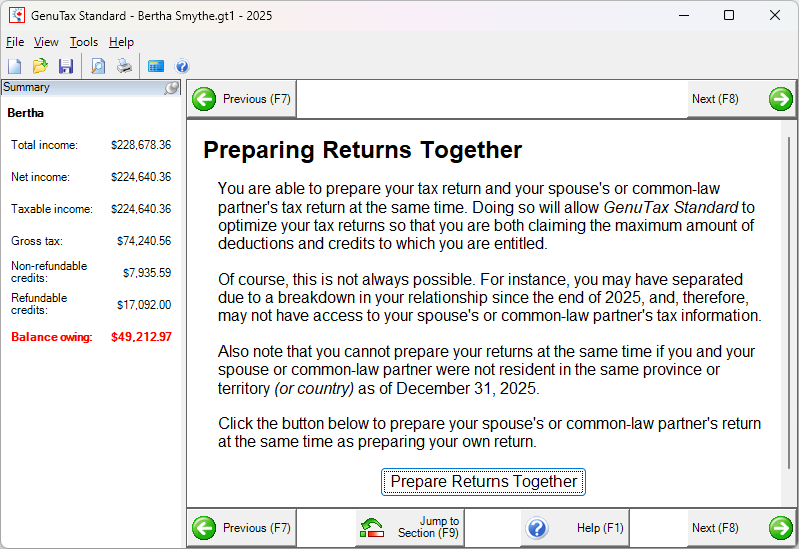

If applicable, GenuTax Standard allows you to prepare your tax return and your spouse or common-law partner's tax return at the same time. Doing so will allow the software to optimize your tax returns so that you are both claiming the maximum amount of deductions and credits to which you are entitled.

Early in the interview, you are asked whether or not you wish to prepare your tax returns together.

If you wish to prepare your tax returns together, click the "Prepare Returns Together" button. The following dialog box now appears.

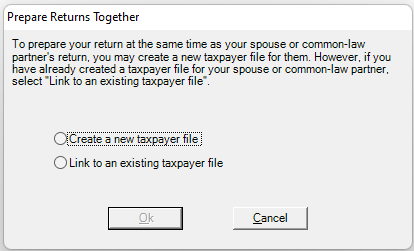

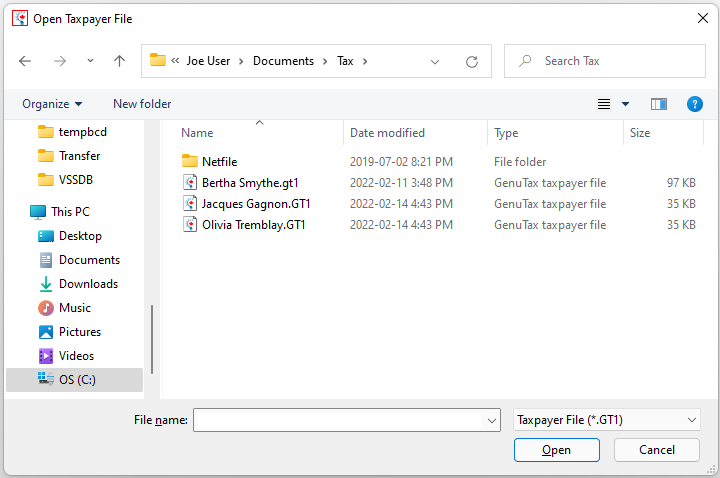

If your spouse or common-law partner's taxpayer file already exists, select "Link to an existing taxpayer file". You will now be able to select your spouse's' or partner's taxpayer file in the "Open Taxpayer File" dialog box.

If you need to create a new taxpayer file for your spouse or common-law partner, select "Create a new taxpayer file" in the "Prepare Returns Together" dialog box. You can then create the new file as described in the Help topic, Creating a New Taxpayer File.

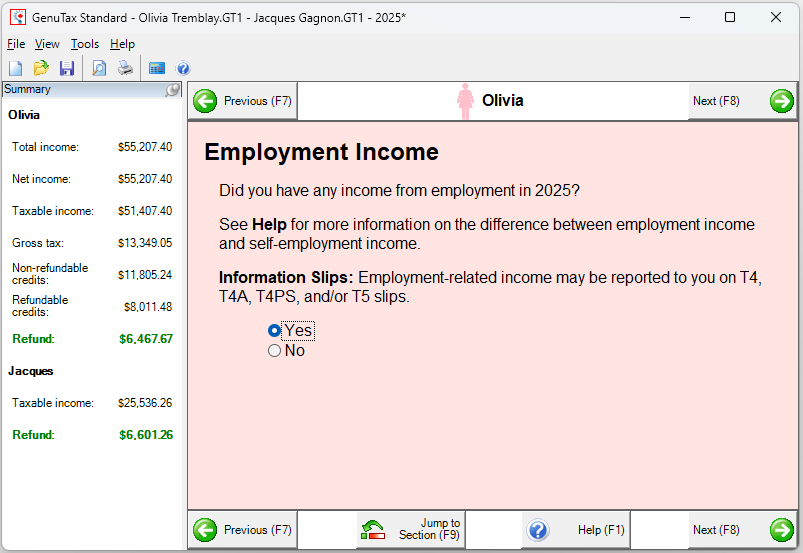

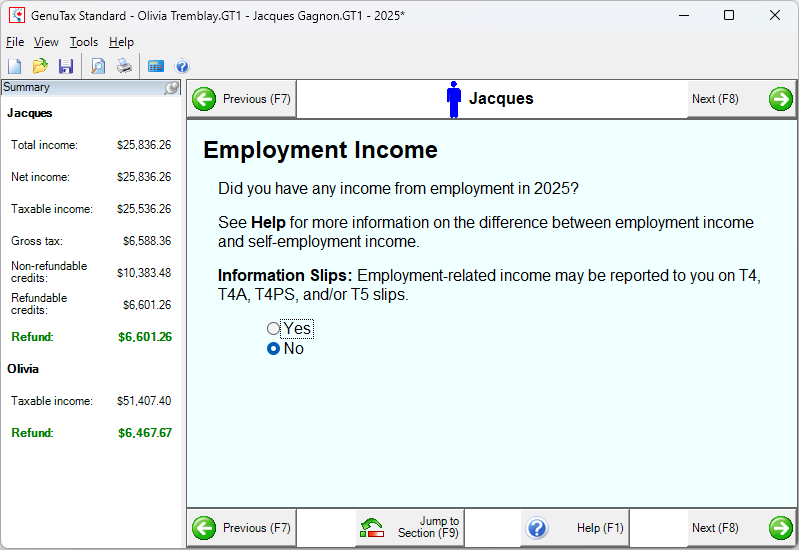

Once your taxpayer file has been linked to your spouse or common-law partner's file, as you proceed through the interview, questions that apply to each spouse or partner will be indicated by a different icon at the top of the window, as well as a different background colour in the Interview screen.

For interview questions that apply to both partners, the background colour of the screen is white.