GenuTax Standard - Program Help - Creating a New Taxpayer File

In GenuTax Standard, an individual's tax return data for more than one year is stored in a single taxpayer file. For example, the tax returns for all the years from 2003 through 2025 for Jane Doe can all be stored in a single taxpayer file named "Jane Doe.gt1".

To create a new taxpayer file, perform one of the three following actions:

- Click the New Taxpayer File button

on the toolbar;

on the toolbar; - Use the Ctrl + N keyboard shortcut (i.e. While holding the "Ctrl" key on the keyboard press "N"); or

- Select the File | New | Taxpayer File menu item.

Note: If you have already prepared a tax return for a previous year, you should not create a new taxpayer file. Instead, you should open the previously created taxpayer file, and then create a new tax return within that file.

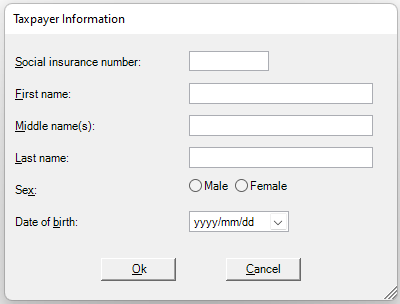

When you create a new taxpayer file, the Taxpayer Information dialog box will open.

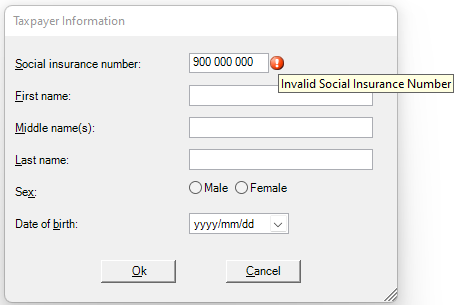

If there is a problem with one of your entries, a red dot will appear beside the entry field. Move your mouse pointer over the dot to see the error message. For example, if the Social Insurance Number you enter is not valid, the message, "Invalid Social Insurance Number" will appear.

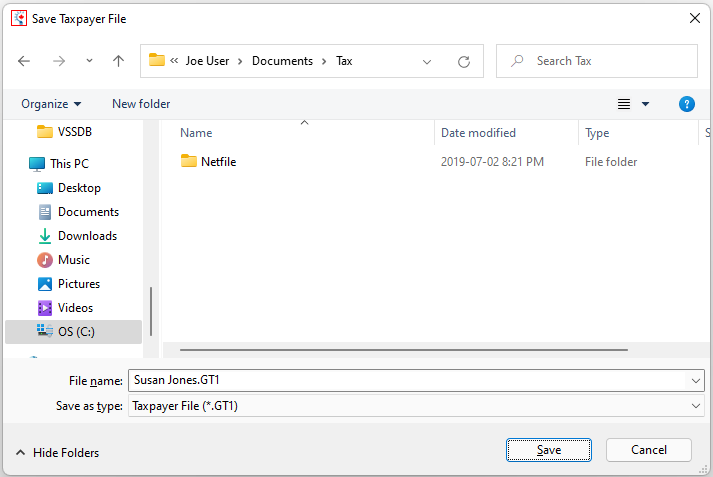

After you have successfully entered your personal information, you will be prompted to save your taxpayer file.

By default, GenuTax Standard will save your taxpayer files in the "Documents\Tax" folder within your Windows user account. However, you can use the Save Taxpayer File dialog box to change the location the taxpayer file will be saved in.

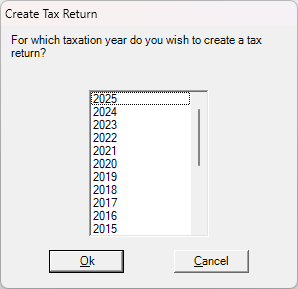

Once the taxpayer file has been saved, you must indicate for which year you would like to create a tax return.

Note: If you are preparing more than one tax return for yourself, you should prepare the oldest tax return first. For example, if you are preparing your tax returns for 2024 and 2025, prepare your 2024 tax return first. This will ensure that appropriate amounts are carried forward from 2024 to 2025 when you create your 2025 tax return.

After making your selection, you may begin completing the interview for the selected year.