GenuTax Standard - Program Help - Opening a Taxpayer File

To open an existing taxpayer file, perform one of the three following actions:

- Click the Open Taxpayer File button

on the toolbar;

on the toolbar; - Use the Ctrl + O keyboard shortcut (i.e. While holding the "Ctrl" key on the keyboard press "O"); or

- Select the File | Open | Taxpayer File menu item.

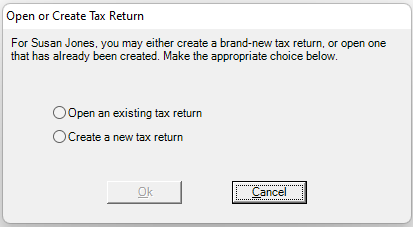

When you open a taxpayer file, you are given the following two options:

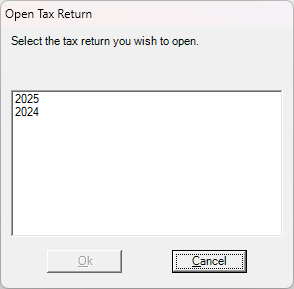

Open an Existing Tax Return

If you are opening an existing tax return within the taxpayer file, you have to select which tax return you wish to open.

After making your selection, you may continue completing the interview for that tax return.

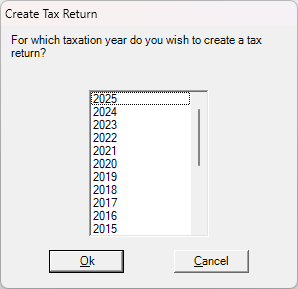

Create a New Tax Return

If you are creating a new tax return within the taxpayer file, you must indicate for which year you would like to create a tax return.

After making your selection, you may begin completing the interview for the selected year.

If you have created a tax return for the year before the year you selected, data will be carried forward to the new tax return. For example, if you are creating a new 2025 tax return, and you have already created a 2024 tax return in the open taxpayer file, appropriate tax data will be carried forward from 2024 to 2025.