GenuTax Standard - Program Help - Using ReFILE to Change Your Tax Return

ReFILE is an online service that allows you to send an adjustment for your tax return to the Canada Revenue Agency (CRA).

In addition to being able to file adjustments to the 2025 tax return, if you need to change your tax return for 2022, 2023, and/or 2024, you may also use GenuTax Standard to file the adjusted tax return for any of these years over the Internet using ReFILE, if your tax return is otherwise eligible.

Here is a detailed set of step-by-step instructions for using ReFILE in GenuTax Standard:

-

Assuming you have successfully used NETFILE

for a tax return, open your existing taxpayer file, and choose the year you wish to open. Then, go back to certain sections of the interview

to make the required changes, by clicking the "Jump to Section" button. If a certain topic does not appear in the list of interview sections,

you may be using the streamlined interview option. To go back and modify your streamlined interview selections, click "Jump to Section", and select "Type of Interview".

-

After making the necessary changes to the tax return, go to the end of the interview, by clicking "Jump to Section", and selecting "Filing the Tax Return".

-

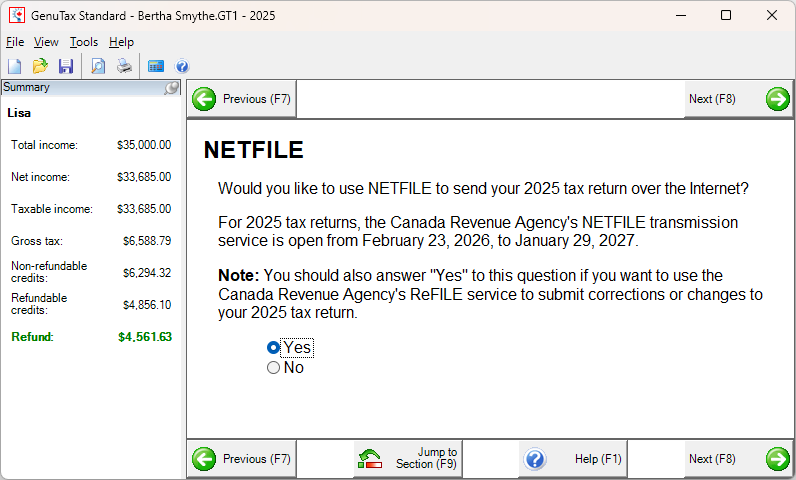

Confirm that the answer to the question regarding using NETFILE is still "Yes".

-

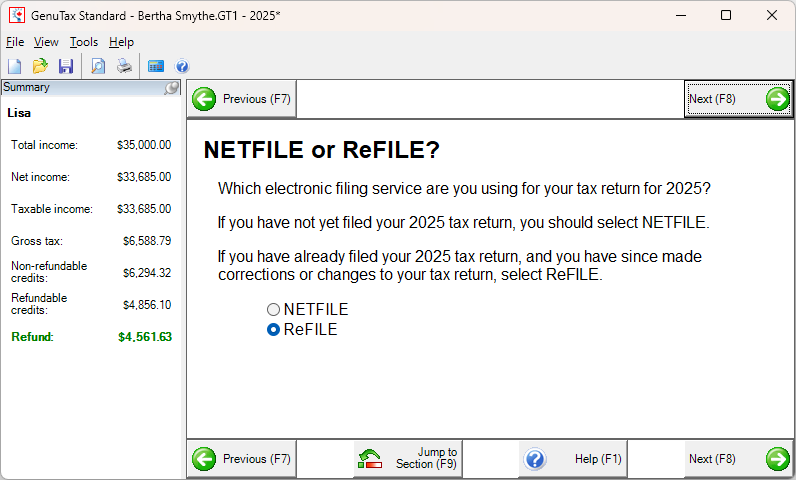

Go forward a few steps until you see the following question and select "ReFILE" as your answer.

-

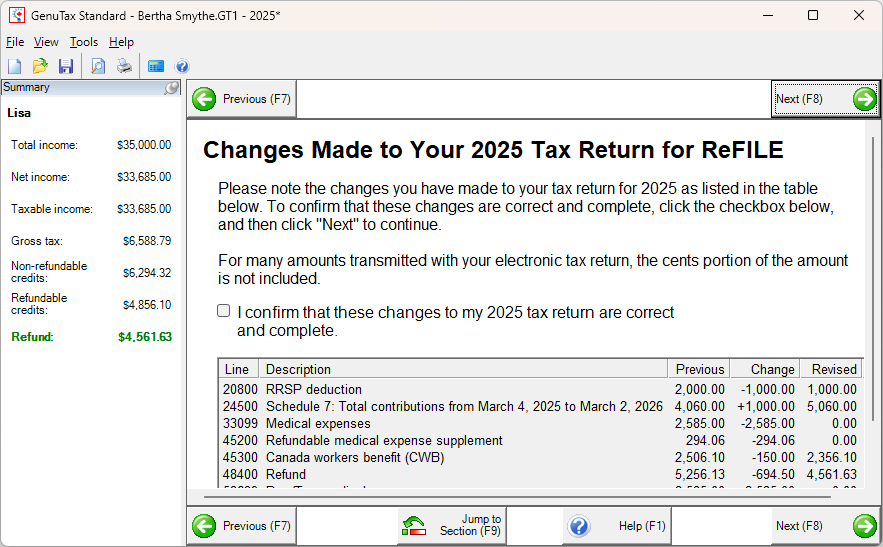

After clicking "Next", review the summary of changes being made, and click the checkbox to confirm these changes.

-

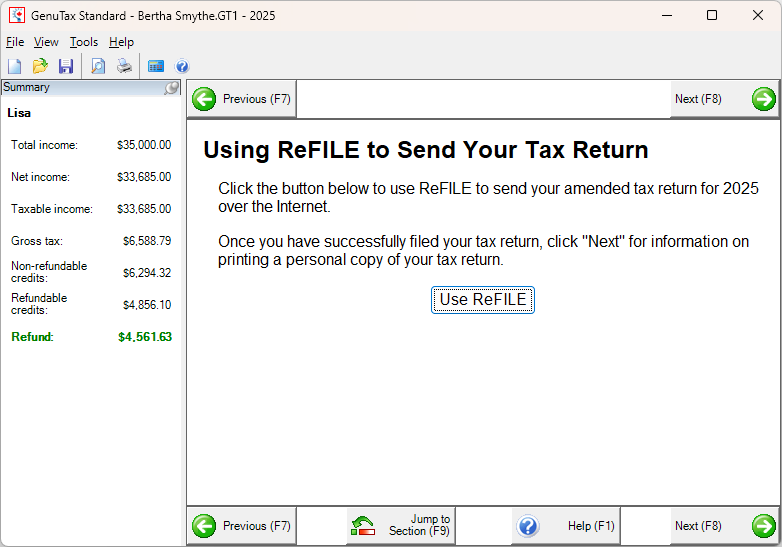

On the next step in the interview, to launch the process of using ReFILE to submit your adjusted tax return, click "Use ReFILE".

-

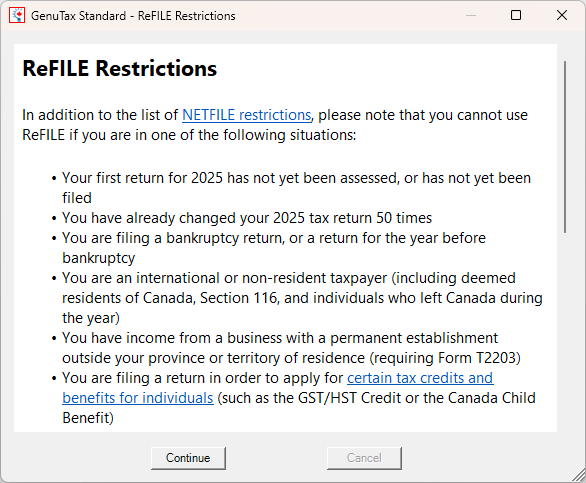

Next, read the list of ReFILE Restrictions which appears, and then click "Continue".

-

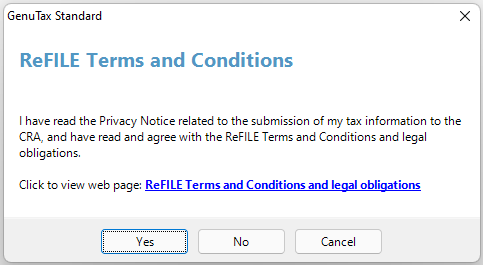

You are asked to review the terms and conditions for using ReFILE. Click the web page link to view and

read the CRA document.

To agree with these terms and conditions, and proceed to send your adjusted tax return to the CRA using ReFILE, click the "Yes" button.

-

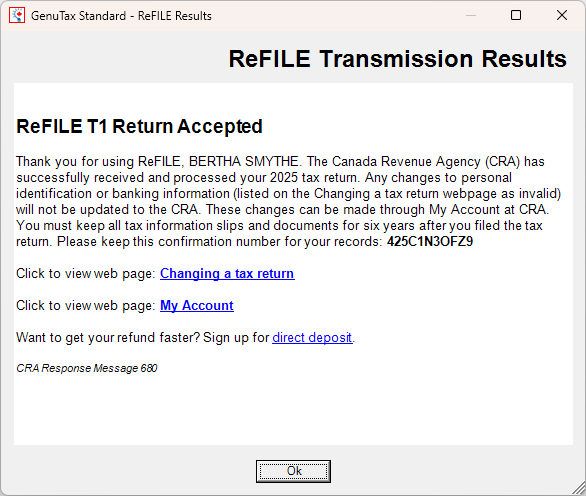

If the Canada Revenue Agency successfully receives your adjusted tax return, you should see a message similar to the following, along with a confirmation number.

-

If you are preparing two tax returns together

for spouses or common-law partners, you

must proceed further in the interview, and follow the above steps to use ReFILE for the other spouse's or common-law partner's tax return as well. Even if

you did not change the other spouse's or partner's tax return directly, it is highly likely that any changes in your own tax return resulted in changes to certain

tax deductions and credits claimed by your spouse or common-law partner. Therefore, it is advisable to use ReFILE for both tax returns.